Click on the link to listen rather than read:

Click on the link to listen rather than read:

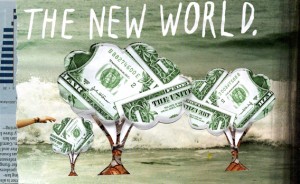

Finding Financial Independence in the New World

I sat like a little kid, with big scissors and tiny scissors. Glue sticks. Cardboard. And a bunch of magazines I had around the house: The Economist, Entrepreneur, Wired, a Chico’s catalog, Wharton magazine and MORE (‘The Best-Selling Magazine for Women Over 40”).

(Click on the image to enlarge)

My instructions were to cut out images and put together collages that appealed to me, that “said” something to me. (We’d worry later about what they meant.)

The more I cut and pasted, the more I felt like I was back in third grade. It felt so good, I was still at it at 2 a.m., when I finally tore myself away and made myself go to bed. I had several pieces of soul-reflecting artwork to look at in the morning.

The collage you see above is the one I love the most. It sits over my computer screen so I can see it whenever I look up. It influences my decisions and inspires me to keep moving forward.

Let me tell you what I see in it.

The New Economy = The New World

After the economic tsunami of 2008, everything changed. All the “economic rules” we thought we could count on went wonky. Financial markets no longer reacted as we thought they should, because government intervention skewed things with gushes of newly printed money. When things should have gone up, they went down. And some things even went sideways.

The one safe investment we all counted on—the equity in our houses–betrayed us. Funds flip-flopped like a dying fish on the sand. Stocks took a steep nose-dive, then climbed back up against all logic. Gold spiraled up on every piece of bad news, and tumbled on every good report.

Interest rates hovered around zero, making savings accounts losers. Official inflation rates stayed around an artificial 1-2 percent while real prices in supermarkets skyrocketed by 15, 25 and 50 percent. To this day, my clients ask me where they can invest their savings safely. And to this day I say, “Diversify, diversify, diversify.” And then I add, “Be sure to also invest in you.”

[The little upside-down strip of Economist magazine along the left on my collage represents all the reports, analyses and tables that reflect what used to be sacrosanct. Today the numbers are so manipulated, they’re virtual fantasy.]

Money Does Grow on Trees

The number of people who were shaken out of their slumber since 2008 is huge. Suddenly jobs were no longer a source of security. Many landed in unemployment lines, trying to figure out where they fit in the new economic reality. And many were surprised by the powerful entrepreneurial juices they didn’t even realize flowed through their veins.

These entrepreneurs are the people who are no longer letting bosses or corporate policy determine how much they can make. They’re the ones risking their fortunes in the marketplace of concepts with their business ideas, many of which grew out of their real interests (or passions) in life. They’re reaching for financial independence.

Not all will succeed. And no one said it would be easy. But they have a far better shot at picking money off those money trees in my collage than people who are sitting around, waiting for the post-industrial economy to decide where there might be an opportunity for them.

Financial success may actually come from a quilt of patched-together activities, rather than from a single job. Or one half of a couple may work in traditional business, while the other reaches for the brass ring.

In any case, they have taken back responsibility for financial independence, for their own well-being and that of their families. Besides redefining how they earn money, they’re also redefining their lifestyles and what their retirement will look like. Taking action, then course correcting, is their mantra.

Limitless Potential

See the ocean backdrop in the collage?

That to me represents what technology has done for us in the past decade or two: it has opened up the entire world and given us access to its vast markets. No longer are we constrained by geography or by high costs of entry into different businesses.

Granted, no business can be set up for free. But the old costs of “being in business” have diminished greatly. Websites replace brick-and-mortar display cases. Social media and online advertising replace the Yellow Pages and magazine ads. Skype and Vonage have cut communications costs down to size.

And, once a business concept offers true value to its potential market, wave after wave of prospects roll in and swirl in the foam at our feet. It’s then up to us to serve them competitively and well—and to turn them into loyal customers.

Never has the uncertainty of traditional business been greater. But then, never has the potential been greater for those willing to reinvent themselves to fit into The New World and offer goods and services that truly meet the needs of the consumers of today.

Let me know in the comment section below what you’ve done to align yourself with the economic reality of today to ensure your own financial independence.

Bio: Sharon O’Day lost everything at age 53: her home, her business, everything. But how could that be? She’s an expert in global finance and marketing with an MBA from the Wharton School. She has worked with governments, corporations, and individuals … yes, she was the secret “weapon,” if you will, behind many individuals in high places. Yet she did! Since then, with her finances completely turned around, Sharon has gone on to interview countless women. She’s done extensive research to understand how that could have happened, especially with her strong knowledge of numbers and finance.

Bio: Sharon O’Day lost everything at age 53: her home, her business, everything. But how could that be? She’s an expert in global finance and marketing with an MBA from the Wharton School. She has worked with governments, corporations, and individuals … yes, she was the secret “weapon,” if you will, behind many individuals in high places. Yet she did! Since then, with her finances completely turned around, Sharon has gone on to interview countless women. She’s done extensive research to understand how that could have happened, especially with her strong knowledge of numbers and finance.

The surprising answers are shared in her posts, articles and an upcoming book. Today her mission is to show as many women as possible how to become financially free for the long term, through her coaching programs. She has developed a step-by-step plan to get past all the obstacles that keep women broke and scared … and from reaching the financial peace of mind they so deserve … if they’re willing to do what it takes!